triple bottom stocks meaning

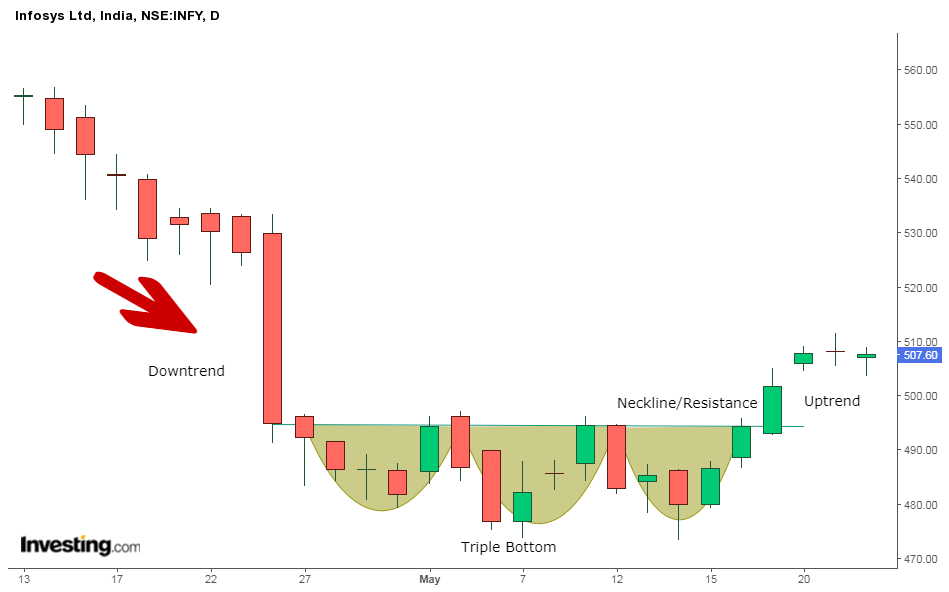

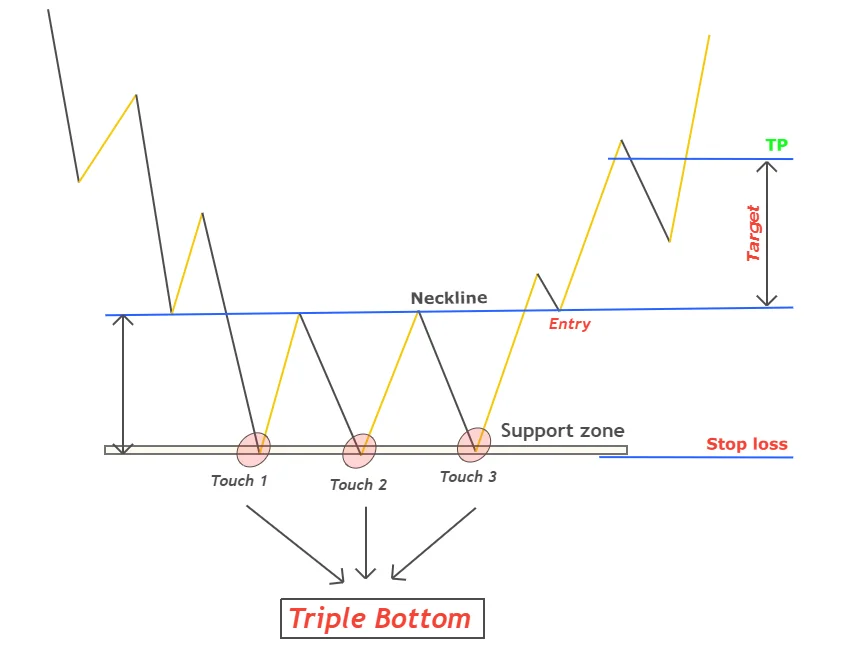

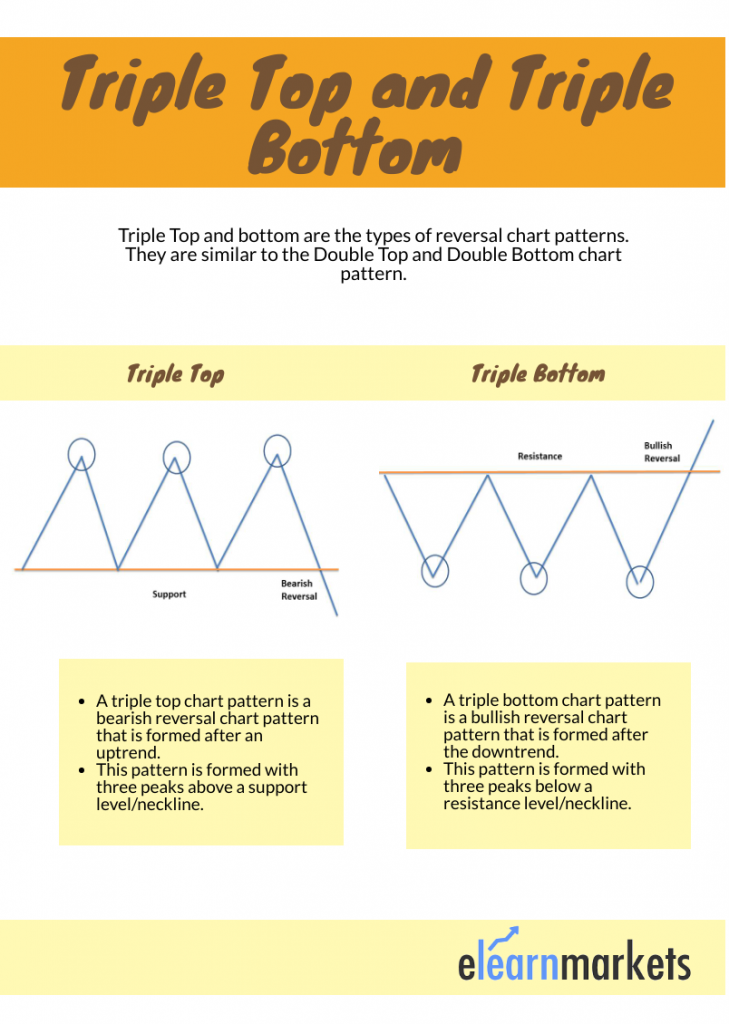

Ad Yieldstreet specializes in investments beyond the stock market for retail investors. Triple Bottom The triple bottom is a technical analysis pattern used to forecast the reversal of a prolonged downtrend.

Triple Bottom Line also known as TBL or 3BL is a transformational framework for businesses to achieve sustainability and financial success.

. Triple bottom patterns are a bullish pattern. Triple Bottom Line is an accounting approach that focuses on creating a sustainable method of execution for corporates. The Triple Bottom Line in business.

Free 2-hour Trading Workshop and Lab our investing QuickStart Kit Stock Picks more. Diversify your portfolio by investing in art real estate legal and more asset classes. It is one of the three major reversal patterns along with.

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. The Triple Bottom is one of the technical formations that indicates a bullish outlook for the stock commodity index. It reflects building up of positive sentiment among market players and.

While the opening term denotes the meaning of four levels or layers the bottom line is something you need to. Triple Bottom - Triple Bottom Pattern A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed. After the first valley is formed price goes up either quickly or gradually.

The pattern is created when three troughs appear at the nearly the same. A triple bottom is a reversal pattern meaning that it is a signal of change in the current direction of a market or trend. Ad Live hands-on investing workshop that will forever change how you look at the market.

The Candlestick pattern shows the 3 major support levels of a stock from. The difference between triple tops and triple bottoms is the direction of the market. It consists of three valleys or support levels.

The term quadruple bottom line consists of two common words. The triple bottom line definition brings people and the planet into the equation. A triple bottom is a reversal pattern with bullish implications composed of three.

After the stock breaks out the first price target is the width of the triple bottom or triple top. Triple Bottom is helpful to identify bearish stocks stock that have been trading weak. Learn More About American Funds Objective-Based Approach to Investing.

It is an economic concept that includes three.

The Triple Bottom Candlestick Pattern Thinkmarkets En

Triple Bottom Pattern And Triple Top The Ultimate Guide

Double Bottom Chart Pattern Strategy

The Complete Guide To Triple Top Chart Pattern

Understanding Stock Charts What Do Green And Red Candlesticks Mean

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-02-8412f60315fe4e75801c37d04bebd526.jpg)

Technical Analysis Triple Tops And Bottoms

/cupnhandle-b1a28683150e48578a72d53b6c18f7a2.jpg)

How To Trade The Cup And Handle Chart Pattern

The Triple Bottom Candlestick Pattern Thinkmarkets En

7 Chart Patterns Used By Technical Analysts To Buy Stocks

How To Use Double Top And Double Bottom Chart Patterns Youtube

Triple Bottom Reversal Chartschool

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

Triple Bottom Reversal Chartschool

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

How The Triple Bottom Reversal Pattern Works 1 Options Strategies Center

Triple Bottom Pattern And Triple Top The Ultimate Guide

Trading The Triple Bottom Stock Chart Pattern Youtube

The Triple Bottom Candlestick Pattern Thinkmarkets En

How The Triple Bottom Reversal Pattern Works 1 Options Strategies Center

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)